From curbside food trucks to Michelin Star dining, we built Hone to help independent restaurants manage their books and make more profit.

Our accounting platform combines leading technical expertise with years of profitable restaurant operating experience to help give you the support you need. If you pay taxes, manage vendor bills, and stress over payroll, then we can help.

"The Hone team are proactive, accommodating and an absolute pleasure to work with. Their specific expertise in the restaurant industry is breath of fresh air. They provide a remarkable personalized service and a level of professionalism second to none, thank you Hone!”

Anthony Floro Jr

GM, Liv's Juice & Acai Bar

“Hone helps me manage expenses so I can pay attention and keep my eye on the big picture."

Jay Carr

Durk's BBQ

"We added a second unit during the pandemic but I sleep well knowing that Hone is managing my bills and expenses"

Jessi Crimmins

Revive & Co

"Hone worked with me to assess my labor spend and needs so that I was able to bring down my labor spend without affecting service."

Cheryl Straughter

Owner & Chef, Soleil Restaurant & Catering

“Operating a group of busy seasonal restaurants here on Martha's Vineyard means that time is always the resource we lack the most. Working with Hone has allowed us to make time go from being a scarcity to a surplus.”

Ashish Mitra

The Covington | The Port Hunter | Martha’s Vineyard, MA

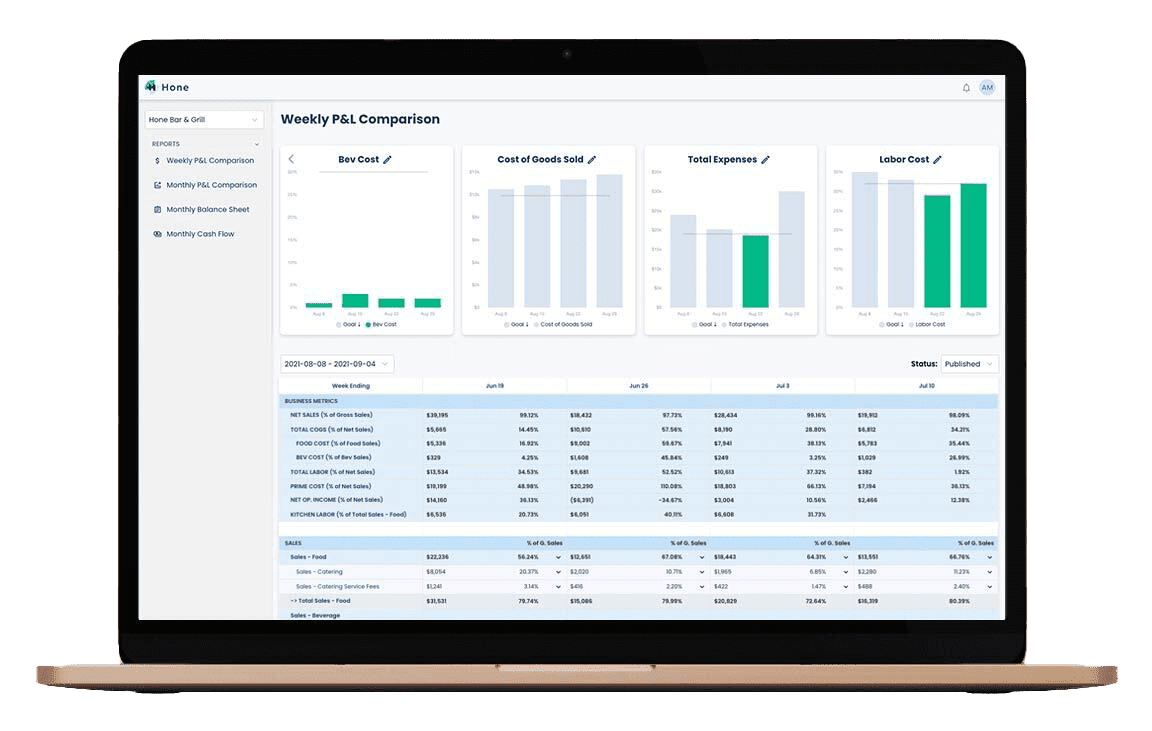

“Being able to drill down to actual invoices and bills on a weekly cadence with a couple of clicks is much more efficient than wading through Quickbooks; having the weekly snapshots and detailed P&L available anytime is a major advantage for our team.”

Eric Heckman

Caddies On Cordell | Bethesda, MD

Small labor and food cost oversights can cost you big when it’s time to pick up the tab. Hone provides weekly prime-cost reports to help you monitor, manage, and make adjustments throughout the month.

If the words “sales tax compliance” send chills down your spine, you’re not alone. Most restaurateurs struggle to manage daily sales tax.

Hone tracks sales tax from your POS and 3rd party sales channels. Then when it’s time to pay the bills, we’ll take care of it so you don’t have to!

Customers love your business because your secret recipe combines quality and efficiency. But to keep up the pace, you rely on vendors that must be paid on time.

Hone helps you track your vendor expenses weekly, giving you a closer look at how much you spend and notifying you when it’s time to pay your vendors.

Getting a steady stream of customers is the easy part — your fresh lemon tarts do it every time. In fact, UberEats and GrubHub have become part of your daily income.

Hone keeps track of 3rd party sales, taxes, AND fees so you have a clear picture of your costs for each channel.

In one day, you could be in two, three, or five locations, so mobility is of prime importance. The last thing you want to do when you get home? Manage the invoices you gathered on the road.

With the ability to scan invoices from an app, you can take snapshots of your expenses and automatically send them to your bookkeeper for payment and categorization.

You’re on your feet all day serving customers

healthy smoothies and juices, so you’re more

than a little tired once you shut down your

point of sale.

Hone’s support team has the technical

experience and accounting knowledge to

guide you through everything from sales tax

to monthly reporting.