By: Nick Gardner

A restaurant P&L is a financial statement that provides a comprehensive overview of a restaurant’s revenue, costs, and expenses over a specific period of time, typically on a monthly, quarterly, or annual basis. It is a vital tool for restaurant owners, managers, and investors to assess the financial health and profitability of the establishment. The P&L statement summarizes the revenues generated from food and beverage sales, as well as other sources such as catering or private events. It also itemizes the various costs and expenses incurred in running the restaurant, including food and beverage costs, labor expenses, rent, utilities, marketing, and other operational expenses. By comparing the revenues against the costs and expenses, the P&L statement calculates the net profit or loss for the given period, providing valuable insights into the financial performance and efficiency of the restaurant’s operations.

A restaurant P&L encompasses various key pieces of information that are crucial for assessing the financial performance of the establishment.

The P&L statement provides a detailed breakdown of the sales and revenue generated by the restaurant. This includes the revenue from food and beverage sales, as well as any additional income sources such as catering or private events. The sales section typically provides information on the total sales volume and the average check size, offering insights into the restaurant’s pricing strategy and customer spending patterns. By analyzing this data, restaurant owners and managers can assess the revenue trends, identify high-selling menu items, and make informed decisions regarding pricing, promotions, and menu optimization.

The cost of goods sold (COGS) is a crucial component of a restaurant P&L statement. It represents the direct costs incurred in producing the food and beverages sold, including the cost of ingredients, raw materials, and any other expenses directly tied to the production process. The COGS section of the P&L statement enables restaurant operators to evaluate the profitability of their menu items by comparing the cost of producing the dishes with the revenue generated. By monitoring the COGS closely, restaurants can identify any cost fluctuations, implement cost-saving measures, and ensure proper inventory management to maintain healthy profit margins.

The P&L statement also includes a comprehensive breakdown of the restaurant’s operating expenses. These expenses encompass various aspects of running the business, such as rent, utilities, payroll, marketing, insurance, maintenance, and other general overhead costs. The operating expenses section allows restaurant owners and managers to analyze the allocation of their resources and identify areas where cost optimization is possible. By closely monitoring operating expenses, restaurants can make informed decisions regarding staffing levels, vendor contracts, marketing strategies, and other aspects that can impact the overall profitability of the business.

In summary, a restaurant P&L statement provides a wealth of information, including a breakdown of sales and revenue, cost of goods sold (COGS), and operating expenses. By analyzing these components, restaurant owners and managers can gain valuable insights into the financial performance of their establishment, make data-driven decisions, and implement strategies to maximize profitability.

A profit and loss statement for a restaurant can be extremely helpful or extremely confusing depending on who you are and how that data is presented. In general, the output from your accounting package needs to be massaged to turn it into a useful operations tool.

A well-prepared P&L statement is packed with so much useful information that it can be overwhelming, especially for non-accountants more interested in ladles than ledgers. Keeping things simple, a restaurant P&L statement should include at least the following five main categories:

However, each restaurant is unique, and its P&L statement should be customized to match business needs, breaking down each of these categories into smaller sections as required. Unnoticeable outlays (such as waste disposal or insurance) can nibble away at lean margins, while peripheral income streams (like branded merchandise) may prove unexpectedly profitable.

Creating a restaurant P&L statement involves several key steps to ensure accurate financial reporting and analysis. Here’s a general outline of the process:

Choose the timeframe for your P&L statement, such as monthly, quarterly, or annually. Selecting an appropriate timeframe allows for meaningful comparisons and tracking of financial performance over time.

Start by entering the cost of goods sold (COGS) section in your P&L statement. This involves calculating the direct costs associated with producing the food and beverages sold, including the cost of ingredients, raw materials, and any other expenses directly related to the production process. Accurate tracking of COGS is vital for determining the gross profit margin and evaluating the profitability of individual menu items.

Next, include the operating expenses section in your P&L statement. This should cover various expenses incurred in running the restaurant, such as rent, utilities, payroll, marketing, insurance, maintenance, and other general overhead costs. It’s important to categorize and detail each expense item to gain insights into the financial impact of different aspects of the business. Accurate recording and categorization of expenses ensure comprehensive reporting and facilitate analysis.

Record the daily sales figures for each day within the selected timeframe. This involves tracking the revenue generated from food and beverage sales on a daily basis. It’s essential to ensure accurate and complete recording of sales to have an accurate representation of the restaurant’s revenue stream.

If applicable, include the revenue from third-party sales channels, such as online food delivery platforms or catering services. These additional sources of income should be recorded separately to analyze their impact on overall revenue and profitability.

Include the payroll expenses in your P&L statement. Record the wages, salaries, benefits, and payroll taxes paid to employees on a weekly or bi-weekly basis. Accurate payroll recording helps in assessing labor costs and their impact on overall profitability.

Choose the accounting method for your P&L statement, either accrual-based or cash-based. While cash-based accounting records revenue and expenses when the actual cash transactions occur, accrual-based accounting recognizes revenue when it is earned and expenses when they are incurred. Accrual-based accounting is generally preferred for most restaurants as it provides a more accurate representation of financial performance and helps in matching revenues with their associated costs.

By following these steps and ensuring accurate recording and categorization of financial data, you can create a comprehensive restaurant P&L statement. Regularly reviewing and analyzing the statement allows you to gain insights into the financial health of the restaurant, identify areas for improvement, and make informed decisions to maximize profitability.

Do you think in $ or %?

Successful restaurateurs think not only in terms of the dollar values of their expenditures and revenues. They know that percentages are just as important as absolute figures.

Once you have the spend at the right level of granularity, the addition of key percentages can help you set goals and track them. Seeing these on your P&L next to the $ turns the numbers into insights. Let me lay out a scenario:

A restaurant has $98,357k in net sales, $32,326k in CoGs spend, and $39,123 in Labor spend –

Where should they focus their efforts?

How about now: They are at 27% CoGs/Net Sales and 42% Labor/Net Sales

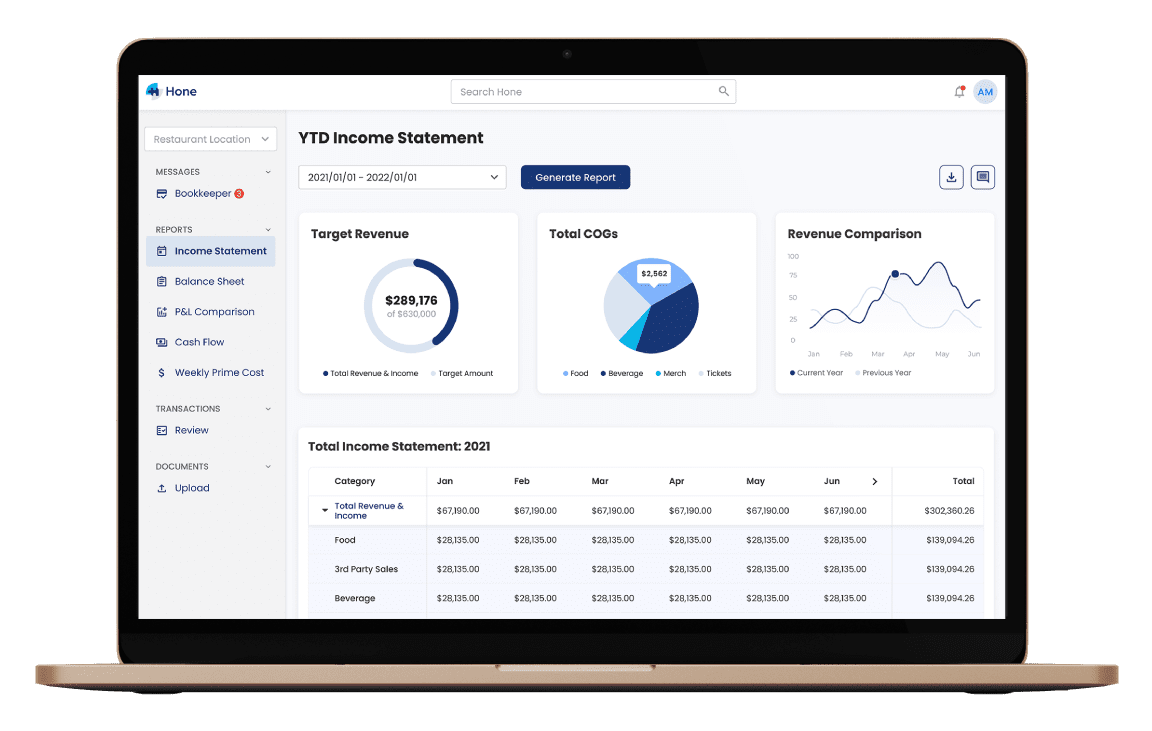

Based on this example, many operators would say; Labor is too high, start there! But without the %s those insights are not obvious. A good granular operations-focused P&L helps you see beyond the $. Hone enables you to customize the P&L so you can see these key metrics and also create custom metrics such as Kitchen labor as a % of Food Sales or Liquor Cost as a percentage of Liquor Sales. We also make it really easy to see what we have recorded for each row in the P&L.

In general, successful restaurants keep their prime costs – basically food, beverages, and payroll – at under 60% of their gross revenues. Much of the remaining 40% is absorbed by taxes and operating costs, often leaving only a wafer-thin slice of the pie as the net profits.

To make your P&L useful, you need some tool, maybe a spreadsheet that converts the export from your accounting package into $ and %s so you can analyze performance and start making decisions. A good restaurant-focused bookkeeper should have a system to do this for you.

Controllable spends – like ingredients and wages – will then be easier to track over time, as sales changes with seasonality, weighing their true value to the business.

One of the main reasons why 50% of new restaurants shut down within five years is the amount of attention paid to their figures (or lack thereof). Profits mean survival – because packed tables every night offer no guarantee of success if revenues are unable to keep pace with expenses.

Understanding the financials is the best way to grow a business, forecast sales and expenses based on past performance and current factors (weather, events…). This is why accurate tracking and recording of everything that goes into a P&L is just as important as cleanliness and portion control; always in the background, but crucial factors for the success of any restaurant.

Many restaurants face similar issues when it comes to keeping their books. But experienced restaurant bookkeeping firms have seen them all before, developing ways of dealing effectively with these problems. So … Do any of these situations sound familiar?

Food and beverage costs are tough to control;

Vendor invoices are scattered everywhere, so CoGs spend is not easily available;

Payroll is high but you are unsure about what can/should change;

Liquor inventory counts are irregular, and don’t line up with sales;

Cash flow is always a concern when paying bills;

Prepping for tax season is a recurring nightmare.

If you can tick any of these items, it’s time to call in the experts. With modern technology, no restaurant owner or manager needs to spend endless hours wading through paper and software systems. Easy to customize, sophisticated financial reporting software can help turn even the simplest eatery into a profitable business.

With the right reporting, which is easy to digest, at a regular cadence you can make great decisions about your operation quickly.

Running a business that responds to so many outside factors (particularly the weather and current events) means keeping a sensitive finger on its pulse right around the clock. Fast decisions based on fresh data can make a real difference between ending the month in the red or the black.

This is why accurate reporting through trustworthy bookkeeping services is so important. A clear presentation of data and metrics, that can be understood at a glance, can steer restaurateurs safely through even the stormiest times. In fact, using your restaurant’s weekly figures as a compass is a quick and trustworthy way of increasing profits and lowering losses.

Responding to the needs of each operation, from corner cafes to local franchisees of nationwide chains, Hone’s specialized restaurant bookkeeping service and reporting platform leave restaurateurs free to focus on their kitchens and dining rooms, keeping their customers happy and coming back for more.

By: Nick Gardner

Fill out the form and a Hone restaurant specialist will reach out to you within 24 hours to schedule your demo. Your demo will include a customized walthrough Hone specific to your restaurant’s unique needs.