As a restaurant owner, you have a lot on your plate. From overseeing daily business operations to ensuring each dish that leaves the kitchen is up to your high standards, there’s no shortage of work to be done. Running a restaurant is a never-ending job—one that’s tough, but also incredibly rewarding.

Because there’s so much to manage, restaurant owners are often expected to be a jack-of-all-trades—sometimes a chef, a team leader, a marketer, an accountant, a bookkeeper, a manager, and more all at once. But most of us didn’t get into this business because we love marketing or finances or any of that. We opened restaurants because we love food, and we thrive on the energy in the industry.

In my experience, that means that a lot of restaurant owners aren’t paying enough attention to their restaurant finances—and often losing out because of it. Relying on a monthly income statement or looking at POS sales reports isn’t enough to truly understand how your business is performing — You need to be monitoring a broader range of metrics, such as food cost and labor cost, weekly and sometimes even daily.

Luckily, managing your restaurant finances on a more regular basis doesn’t have to be complicated. When it comes down to your restaurant accounting and restaurant metrics, there are five numbers you need to pay attention to.

What metrics really matter for restaurant finances?

At a high level, there are five metrics (and a few sub-metrics) restaurant owners should be aware of, in my experience working in and owning multiple restaurants:

- Sales

- Break-Even Point and Contribution Margin

- Cost of Goods Sold

- Labor cost

- Food cost

- Beverage cost

- Prime Costs

- Operating expenses

- Controllable expenses

- Non-Controllable expenses

Next, I’ll explain why these numbers matter and how often you should be reviewing them.

Restaurant sales (Total sales and Historical Sales)

Okay, this one’s obvious: are you making sales?

Restaurant sales = all revenue in a period of time

You need to be bringing in money in order for your business to be profitable. This is a good metric to review weekly at the very least, so that you can track trends and make changes ASAP if something isn’t working. For example, if sales are down more than they should be, it may be time to invest more in marketing. If sales are up, you may want to be ready with all hands on deck.

Additionally, when studying sales performance, it can be helpful to look at the same week or month from the prior year (or 2019 if you were in business before COVID), to balance out seasonality. Note: if you increased your prices, make sure to increase your expected performance by the same percentage to get a true understanding of your sales growth.

Break-Even Point and Contribution Margin

Understanding your break-even point—the point at which your revenue covers all expenses— is fundamental. This metric, coupled with contribution margin, which reveals how much revenue is left after covering variable costs, guides your pricing strategy and overall financial health.

Cost of Goods Sold

This metric delves into the direct costs of producing the food and beverages you serve. Managing your cost of goods sold ensures that you’re maximizing profitability while maintaining the quality your customers expect.

Labor cost

Your labor cost is the total cost of all of your employees that are on payroll. That includes both front of house, back of house, and anyone else on your payroll that helps the restaurant run.

Labor cost % = (total payroll ÷ total sales in a period of time) x 100

The industry target for your labor costs is about 30% of net sales. If your costs are a lot higher than this, it’s likely you need to revisit your staffing situation. For example, when I ran a restaurant at a hotel in DC I had about 40 kitchen employees to manage. It was a large operation: we did breakfast, lunch, and dinner. If I wasn’t on top of the schedule, it was very easy to end up with high labor costs, which then ate into our profitability.

Food cost

Food cost is the total sum of all food products that it took to make the food you’ve served. The industry target for restaurant food costs is about 30% of food sales.

Food cost % = (total food product cost ÷ total food sales in a period of time) x 100

It’s very easy to end up with high food costs, just pick your reason: poor inventory planning, food waste, supply chain challenges, inflation, mismatch of supply and demand, unexpected emergencies, and more.

Even if you’ve plate-costed your menu correctly, small inefficiencies can add up fast. For instance, if you cost out your menu at 30% and you throw away two orders of your most expensive dish every other night for a month because the line cook isn’t paying attention, that could easily bump you up to a 35% food cost. Paying close attention to where you are and where you need to be with food costs is crucial to the business.

Some restaurants may target a higher food cost % due to high supply costs, but balance it out with a lower beverage cost %

Beverage cost

Just like your food cost, your beverage cost is the total sum of all beverage products that it took to make your beverage orders, including soda, alcohol, tea, and more. The industry target for beverage costs is about 30% of beverage sales.

Beverage cost % = (total beverage product cost ÷ total beverage sales in a period of time) x 100

Also similar to food costs, it’s very easy to end up with a high beverage cost. For example, if your bartender gets too generous with their pours, or the wine bottles aren’t stored properly and some of them end up corked, those kinds of things can quickly raise your beverage cost % and cut into a restaurant’s already thin margins.

Together, as a starting point, your food and beverage costs should total about 30% of your net sales.

Prime Costs

Prime cost encompasses all direct costs, including labor and cost of goods sold. Keeping this metric in check is crucial for maintaining healthy margins.

Inventory Turnover Ratio

This metric assesses how quickly you’re using up inventory. A high turnover ratio indicates efficient inventory management, which is crucial for cash flow and profitability.

Operating expenses

Now, the boring but very important stuff: your operating expenses. These are the “must-haves” that keep your restaurant in business. These can actually be broken down into two sub-categories:

- Controllable expenses are things that you have some control over the cost of, including: repairs and maintenance, advertising and promotions, linens, cleaning, and professional services. These should add up to 10-15% of your net sales.

- Non-controllable expenses are items that don’t really vary, or are hard to change on a short-term basis, including; rent, utilities, delivery charges, merchant fees, and insurance. These should also add up to 10-15% of your net sales.

Even though some of these are “controllable,” it can still be challenging to influence these costs, especially with recent inflation and increases in rent. All the more reason to keep an eye on your operating expenses.

Advice on not getting stuck in the weeds

What’s worked well for me in my years of managing restaurants is to prioritize by dollars. Where is your money coming in? Sales is the biggest piece of your finances, so it’s important to continuously work on increasing your sales—finding ways to promote and diversify your restaurant’s offerings. It takes some time and effort, but it’s well worth it to get your restaurant’s page set up on Yelp, Google Business, and other social media platforms.

It’s also important to keep perspective. There are costs that absolutely should be prioritized over others. For example, I find sometimes restaurant operators spend too much time trying to figure out why there’s an extra $300 this month in advertising or discounts, and not looking at their labor cost, which is way too high at 48%. Skip the $300 and attack the higher priority labor cost. Go back to the $300 later once you get the labor in line. It’s all about seeing the bigger picture.

Leveling up your restaurant bookkeeping and finances

Need more ideas on how to manage your restaurant’s finances? Check out our recent article on daily, weekly, and monthly practices to improve your restaurant’s profitability for tips on getting into a regular practice of reviewing your restaurant bookkeeping and financials.

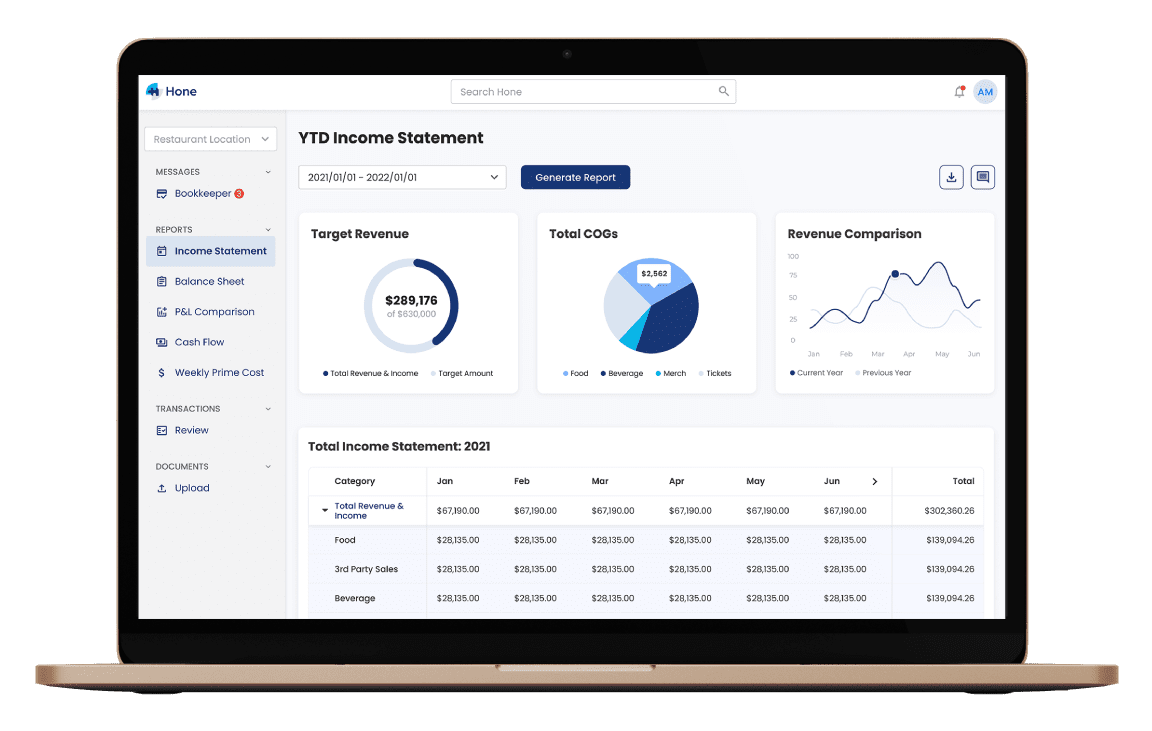

Additionally, consider partnering with a restaurant bookkeeping platform like Hone. Designed by restaurant industry folks for folks in the restaurant industry, Hone makes it easy to manage your restaurant bookkeeping, track sales and cost trends over time, and make more informed decisions about your restaurant. Contact our team to book a free demo today.