A restaurant’s books are as unique as its menu. From how they manage the accounting for tips, to the level of detail they go into for labor, food, and beverage costs, there are an infinite number of ways restaurants can organize their finances. But what’s the best way?

As a Bookkeeping Manager at Hone, I’ve been working on an audit of over 50 different operators to better understand common errors, industry best practices, and how we at Hone can get all of our customer’s books to be as close to perfect as possible. In this article, I’ll share a few of the most common restaurant bookkeeping mistakes I’ve seen—and how to fix them.

1. Being careless with how gratuity and tips are logged

One of the biggest mistakes I’ve seen in restaurant accounting has to do with how tips are logged. Tips are a unique part of restaurant accounting and need to be tracked correctly—or else a business can risk issues with the IRS.

Different states have different laws around how minimum wage and tips should be handled. For more information, check out this great article on a business owner’s guide to restaurant tipping law.

There are well over 50 major restaurant POS systems and most offer multiple ways to handle tips. For this reason, it’s important to make sure your restaurant bookkeeper knows how your restaurant handles tips, so they can accurately reflect this information in your books.

In multiple cases, I’ve seen tips registered under payroll or petty cash, when tips need to be booked separately. This can show up as a negative balance between Payroll Checks, Tips Payable, or Cash, which is often a sign for me that a restaurant hasn’t booked their tips correctly and that I need to track down where they’re listed. Just because that money is showing up somewhere doesn’t necessarily mean that it’s showing up the way that it should be showing up to give you the most insight into your business.

As long as your restaurant bookkeeper knows where everything needs to go, the clean up is easy. We just need to have those conversations to make sure I understand how you’re tracking your tips so that your data is accurate and you can be a data-driven operator. At Hone we’ve started having those conversations during onboarding, so we can clean up existing issues in your Balance Sheet related to tips, and set your books up for success from day one.

2. Not checking your restaurant’s balance sheet

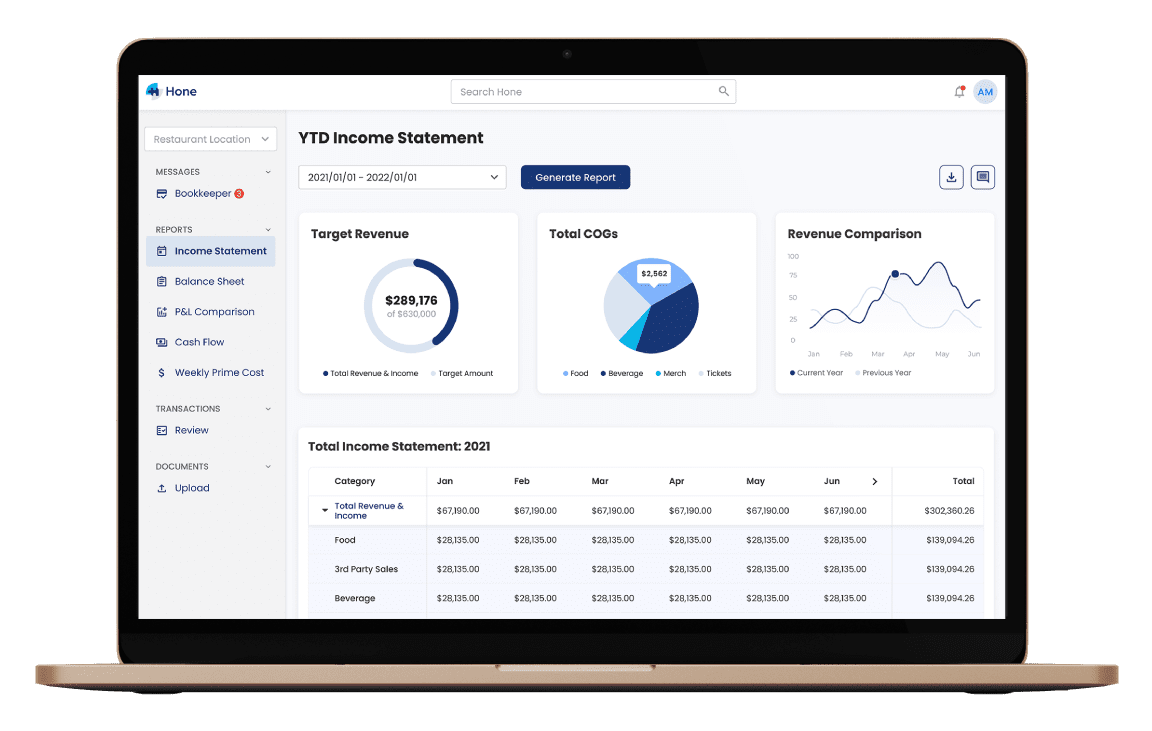

Most restaurant operators are familiar with their P&L, which shows the money going in and out of your business over a period of time. This is great for giving you a sense of your profitability week over week, but you might be missing the bigger picture.

I often joke that only the accountant cares about a business’s balance sheet—until it’s tax time. Your restaurant’s balance sheet is important for getting an overall read of your business. I like to describe it as your business’s report card. Because it includes information about things like loans and other investments, your balance sheet is key to helping you understand if your week to week profits are actually enough.

For example, maybe you had a great month with $100,000 in sales. But if we look at the balance sheet and you have a $10,000,000 loan, you may need to find additional ways to increase your profits and top-line revenue to pay down that massive loan!

3. Not cashing checks

Another thing that has come up a few times in my audit has to do with business partners not cashing their checks right away. Since restaurants can run on such narrow margins, it’s common for owners to hold on getting paid until they’ve had a good couple of months in a row.

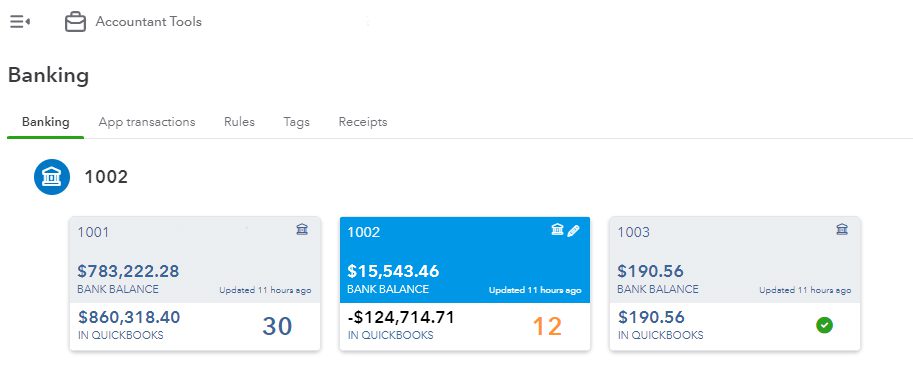

I nearly had a heart attack looking at the books for one of our clients, after seeing a huge discrepancy between what Quickbooks said their bank account balance should be (-$124,000), and what the actual balance was ($15,000). Luckily I knew that the owners had been holding on cashing multiple payroll checks written out to themselves because they didn’t want that to impact the business’s bottom line. Once they cash the checks, the balance should return to normal—but if I hadn’t known that, I would have been very concerned.

4. Not communicating with your restaurant bookkeeper

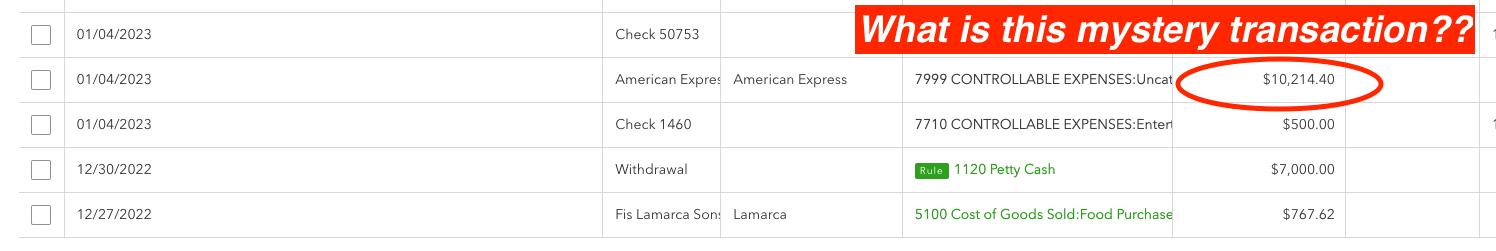

That leads me to my next point: it’s important to always communicate with your restaurant bookkeeper. As a restaurant operator, you’re dealing with so many moving parts each week that it can be hard to look back six weeks ago and remember what a specific line item in your books was about. It’s better to share that information in real time so that your books are as accurate as possible and can provide a realistic picture of how your business is performing.

For example, if I see a check for $10,000 go through to a vendor and that’s out of the normal for an operator, I need to book it correctly. It could be the difference between that check being booked as an asset (like the purchase of a new refrigerator) or a cost of goods sold. How a charge is entered in your books can affect your P&L, potentially providing incorrect information about your restaurant’s profitability. We do our best to learn the business’s patterns and vendors but a little email explaining atypical transactions goes a long way!

What else should your restaurant accountant know about? Here are just a few of the things that can affect your books: how you handle retail sales, gift cards, your number of business partners, how you handle distributions, how granular you get with your labor and cost categories, how much you spend on marketing, if you use a separate system for events, and more. Not sure if it matters? Communicate with your bookkeeper—if they’re worth their salt, they should also come prepared with a checklist of questions to ask you during the onboarding process.

5. Not investing in what makes your business unique

Not strictly a bookkeeping issue, but we do see a lot of trends across our customers’ books at Hone. As a bookkeeper working across a variety of different businesses, you start to see things that stand out.

For example, we had a client who was spending over 10x what other operators were spending on live bands each month. Although this was normal for them, they didn’t realize how unique this was. We brought that up to them: just because your entertainment spending is different doesn’t actually mean that it’s wrong. It just means that you should use that as a selling point of your bar. Nobody else is going to come close to the variety of bands and live performances that they had—they needed to promote what made their business unique.

As Hone grows and adds more customers to our roster, we are uniquely positioned to provide various benchmarks such as typical marketing spend as a % of revenue, or median price per lb of chicken breast in their region. I get really excited about helping our restaurants with these data-driven insights along with their weekly P&Ls or monthly reconciled Balance Sheets.

How Hone builds a true partnership with restaurant operators

Managing a restaurant’s accounting is a work in progress, and the best results for bookkeeping come from a close relationship between a bookkeeper and a client. At Hone, we strive to get to perfect—our goal is to provide you with accurate accounting so you can make data-driven decisions for your business, without opening up a spreadsheet.

By asking questions and learning more about your unique operations, we can help you make more informed decisions about your business. It’s incredible to be able to translate your numbers into something tangible. Seeing how an investment here and a check there can help you grow a thriving restaurant is why we do this work.

Interested in trying out Hone for your business? Get in touch with our team through the form below—we look forward to talking with you!